Analyst from the company ForexMart (ForeksMart)

Brent. 16.03. Oil was able to recover.

Brent crude was able to correct a recent lows was $ 50.24 per barrel. Rise in the price of oil helped the publication of a report from the US Department of Energy, showed unexpected results of participants in commodity markets. Despite the expected increase in oil reserves by 3.2 million barrels, the report showed a decrease of 237,000 barrels. The market reacted to the growth of quotations of "black gold" to the level of 52.55 dollars per barrel. Moreover, support for oil has weakened and the dollar, expecting more decisive Fed rhetoric. Forward to further strengthening and growth of the hydrocarbon value.

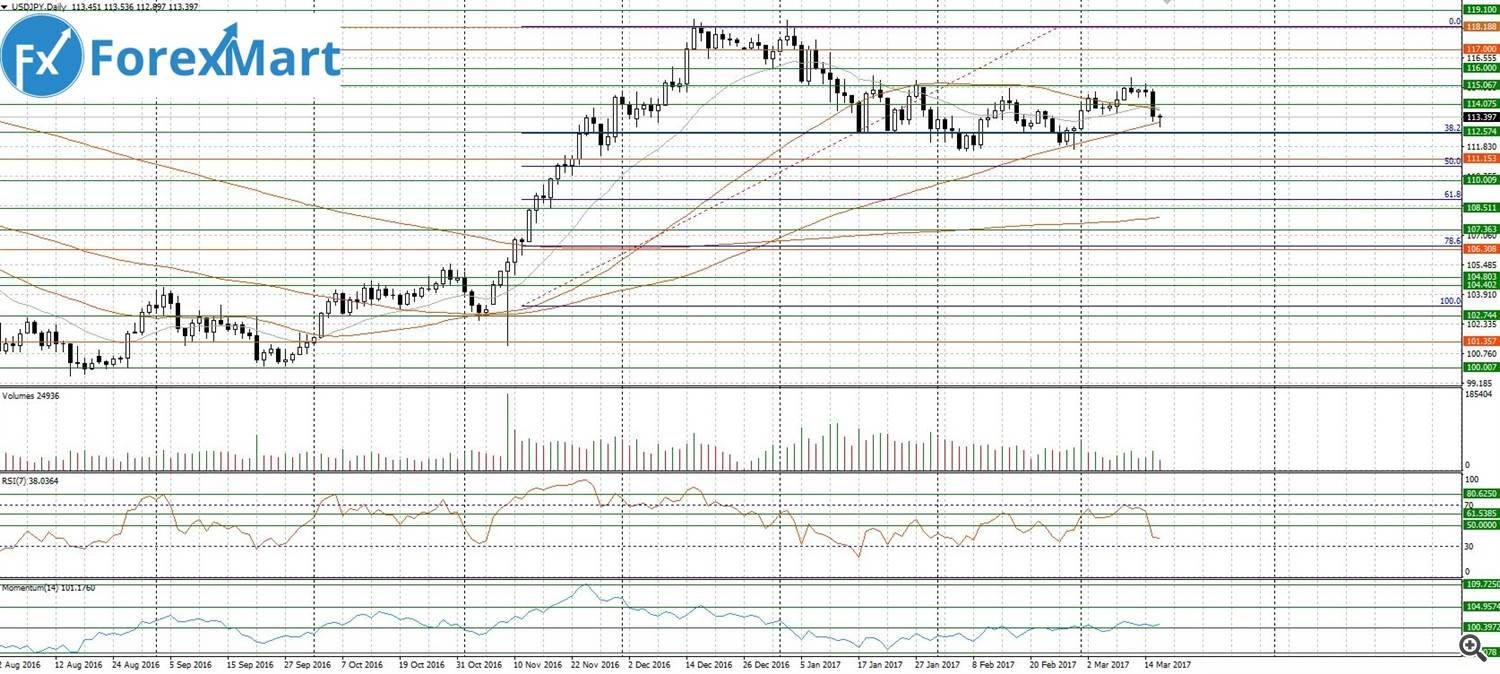

USD / JPY. 16.03. What will the regulator's decision.

Currency pair USD / JPY collapsed yesterday by more than 1,000 points on the background of the US Fed meeting. Increased interest rates and the dollar falls. The fact that the Fed will tighten monetary policy at this meeting, none of the analysts did not doubt the reason for the reaction - the expectations of future increases in 2 or 3. The Bank of Japan today left interest rates at the same negative level. In the medium term, this should strengthen the position of the US currency. Today, the pair is trading in a narrow range in the near future is likely to retest the line 112.50.

Commodity prices forecast on March 16.

Gold seriously increased by comments of representatives of the Federal Reserve. The rate will rise throughout the year two more times, with the result that the precious metal rose to the level of 1225.76. The fate of gold will continue to be dependent on geopolitical factors, such as the elections in France and on the further dynamics of the American currency. In the medium term precious metal will remain under pressure. Today, gold is likely to move into the region in 1222, 1220, 1216.

No comments:

Post a Comment